Funddo, One-Stop Solution for Your All Business Finance Requirement.

Small Merchants / Shop owners face huge challenges in raising funds from bank and other funding institutional. The fund approval process is tedious, and that an approval can take weeks, if not months. Funddo provides unsecured loans to local retailers and small business owners. The business owner can use unsecured business loans for their business need.

1. Download the Funddo Application

Download the Android Funddo Application from the Google Play Store using your smartphone.

2. Register & Create Your Account

Funddo Application uses your mobile number for registering and creating the account. Unique QR Code is generated.

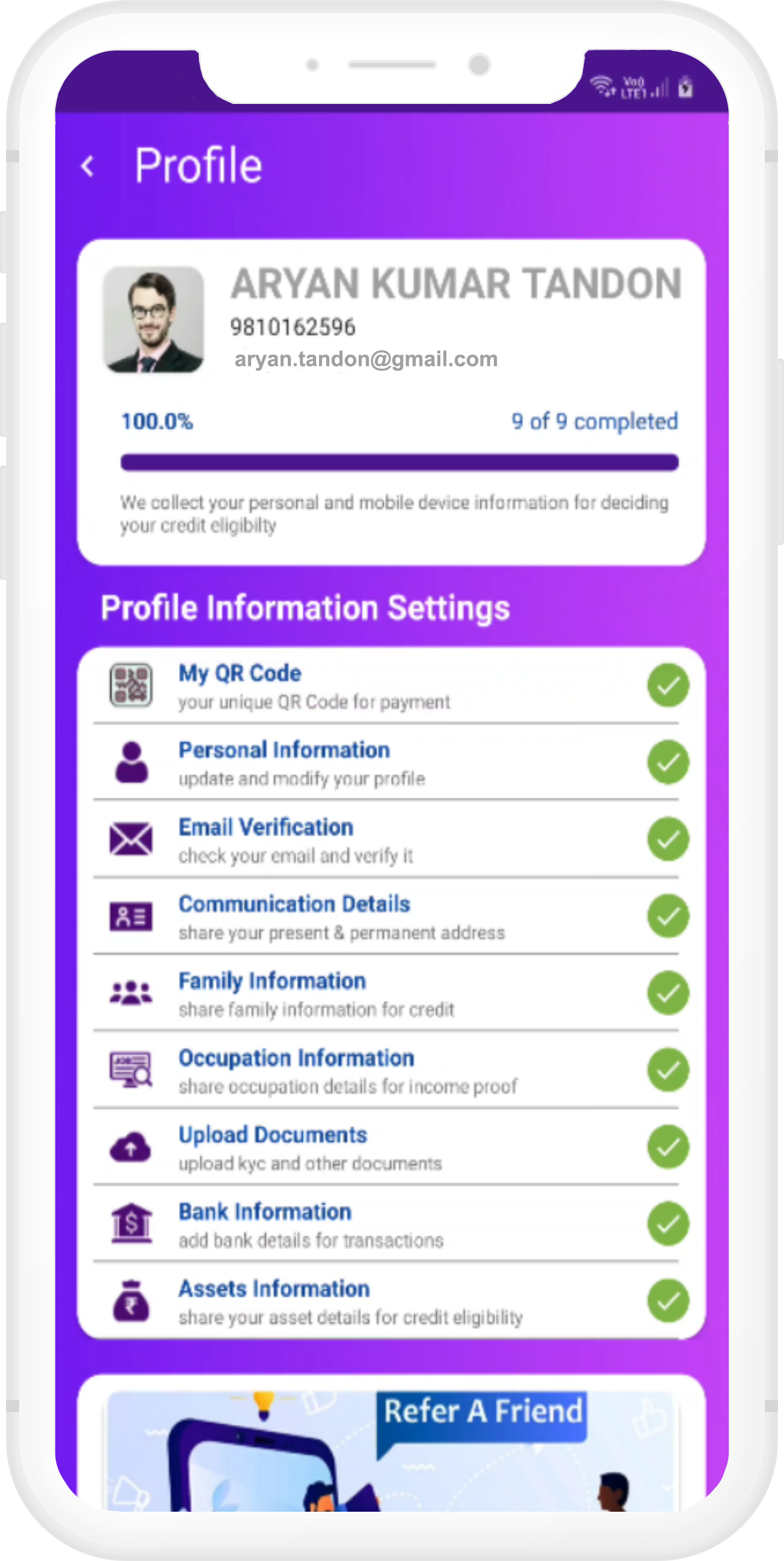

3. Update your Personal Profile

For getting fund one time profiling is important as per Indian Government Guideline.

4. Document Uploading

Upload RBI mandate documents like PAN Card, Aadhar Card, Residence proof and business proof using smartphone.

5. Apply for Fund

Apply for mutiple fund products as soon as you complete the 100% profiling.

6. Disbursement & Collection of funds

As per credit rating funds from Rs.10000 - Rs.100000 is disbursed in registerd bank account and repayment is collected as per schedule.

Get Instant Fund.

When you need it most.

Better, Faster, efficient seamless experience with best ROI. We leverage technology to provide instant affordable funds to retailers an otherwise excluded customer segment.

Build your business credit as you go. Use Funddo funds to grow, build credit with Funddo and unlock larger fund amounts.

Business Credit Line

Most Popular- Rate Of Interest : 0.1% Per Day

- Pay Interest On the Usage Of Credits Only.

- 07 Minimum Days - 30 Maximum Days

- One Time User Registration.

- One Time Processing Fees.

- Retail Insurance Included.

- Hospicash Included.

Term Credit Funding

- Rate Of Interest : 0.07% Per Day

- Pay EMI Equal Distrbuted Repayment Schedule.

- 90 Minimum Days - 360 Maximum Days

- One Time User Registration.

- Processing Fees On Disbursal.

- Retail Insurance Included.

- Credit Insurance Included.

- Hospicash Included.

Get your Business Listed today

Get Funddo’s credit line based on your business credit worthiness. A credit limit, your business can borrow against whenever you need it, repay, and use again—often for a specified term.

Contact us now for free evaluation of your business credit worthiness.

Our Financial Products & Services

Business Term Loan

Short Term Business Loan for long term growth.

Retailer Wallet Credits

Raise your stock. Use wallet fund for all purchases.

Retail Insurance

Insure your shop / store and stock.

Health Insurance

Health Insurance for your near dear ones.

Eng

Eng