Funddo, One-Stop Solution for Your All Business Finance Requirement.

Small Merchants / Shop owners face huge challenges in raising funds from bank and other funding institutional. The fund approval process is tedious, and that an approval can take weeks, if not months. Funddo provides unsecured loans to local retailers and small business owners. The business owner can use unsecured business loans for their business need.

Business CreditLine

Credit Line will bolster to take the business to next level.

Secure Transactions

Digital quick fund transfers to banks and anytime online repayments.

Digital Analysis

Get fund utilization insights, manage fund and grow your business.

Minimum & Digital Documentation

Fill & Post all statuary documentation digitally from Mobile Phone.

Customer Experience

Take fund and manage customer, give seamless service and in-store experience.

Retail Insurance

Insure your shop, store, stock and yourself and your near dear ones.

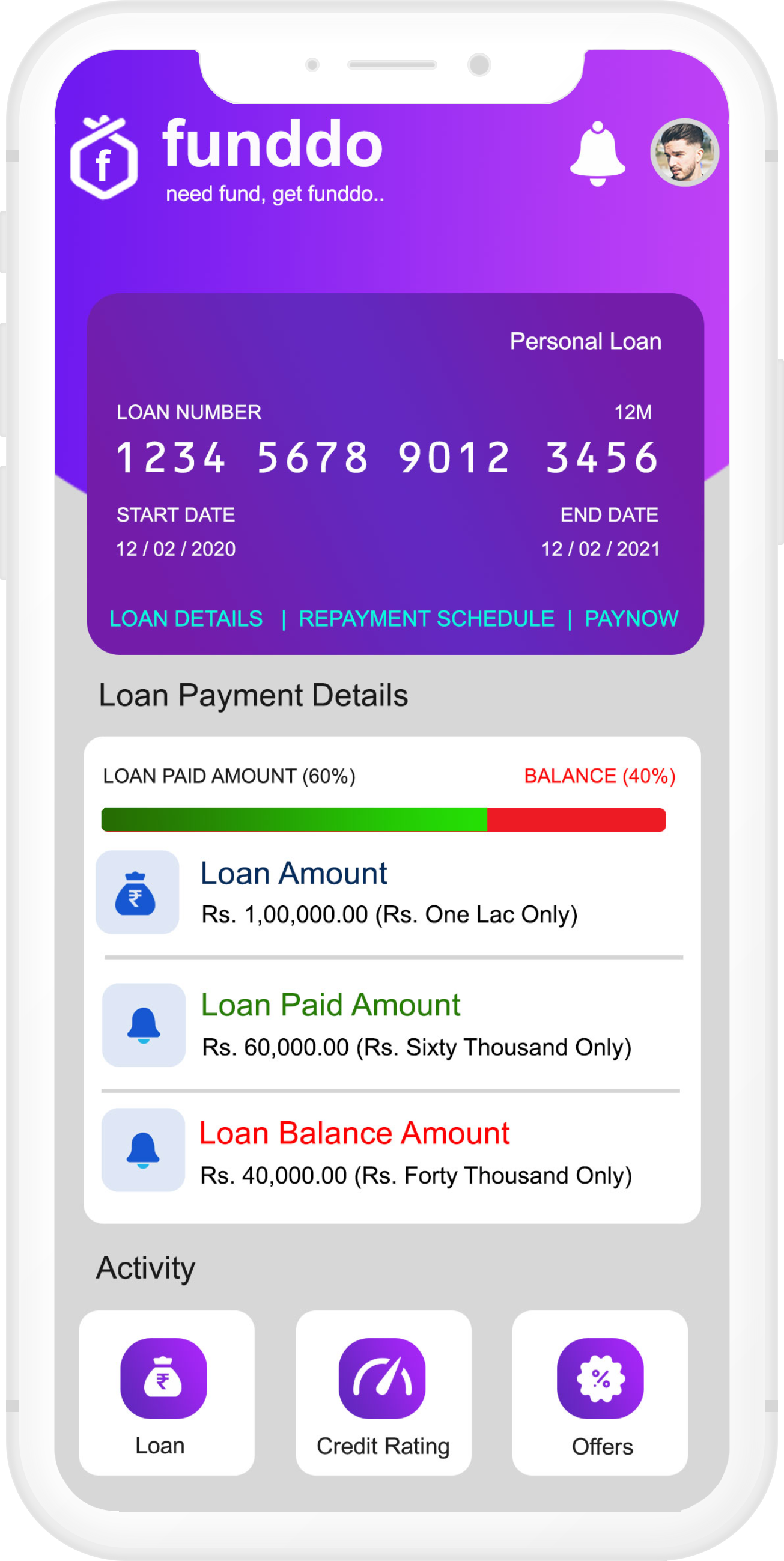

Get Instant Fund.

When you need it most.

Better, Faster, efficient seamless experience with best ROI. We leverage technology to provide instant affordable funds to retailers an otherwise excluded customer segment.

Build your business credit as you go. Use Funddo funds to grow, build credit with Funddo and unlock larger fund amounts.

Business Credit Line

Most Popular- Rate Of Interest : 0.1% Per Day

- Pay Interest On the Usage Of Credits Only.

- 07 Minimum Days - 30 Maximum Days

- One Time User Registration.

- One Time Processing Fees.

- Retail Insurance Included.

- Hospicash Included.

Term Credit Funding

- Rate Of Interest : 0.07% Per Day

- Pay EMI Equal Distrbuted Repayment Schedule.

- 90 Minimum Days - 360 Maximum Days

- One Time User Registration.

- Processing Fees On Disbursal.

- Retail Insurance Included.

- Credit Insurance Included.

- Hospicash Included.

Get your Business Listed today

Get Funddo’s credit line based on your business credit worthiness. A credit limit, your business can borrow against whenever you need it, repay, and use again—often for a specified term.

Contact us now for free evaluation of your business credit worthiness.

Our Financial Products & Services

Business Term Loan

Short Term Business Loan for long term growth.

Retailer Wallet Credits

Raise your stock. Use wallet fund for all purchases.

Retail Insurance

Insure your shop / store and stock.

Health Insurance

Health Insurance for your near dear ones.

Eng

Eng